About Offshore Company Setup:

Offshore companies are permitted to open a bank account in the UAE, however, they cannot issue work visas or have a physical office within the country. Offshore licenses are typically used as holding companies and are mainly incorporated for operations in foreign countries with financial, legal and tax benefit purposes. Offshore companies under free zones such as JAFZA and RAKICC can own real estate in the UAE.

The UAE has over 50 free zones with some offering generic activities for all industries, whereas others are industry-specific.

Advantages:

- Low startup cost

- Speedy incorporation process

- 100% tax-free

- 100% foreign ownership permitted

- No paid-up share capital or audit requirement

- Multiple bank accounts

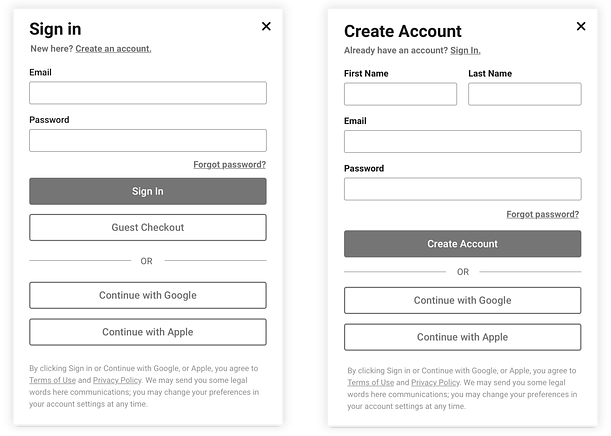

Calculate your business setup cost

Get an estimate for your desired business in your desired currency in under a minute with this cost calculator.

Key Features:

Given below are the key features of an offshore company in the UAE:

minimum of one shareholder is required and corporate shareholders are permitted. International corporate shareholders are required to have company documents attested.

A minimum of one director is required and corporate directors are permitted. Details of directors are not available on the public register.

Every company must have a secretary. A company director may also act as a company secretary.

No minimum share capital is required.

Every company must keep accounting records for 7 years from the date of inception. The accounts do not however have to be filed with the RAK authorities.

Process for offshore license

- Choose business activity

- Finalise company name

- Complete incorporation paperwork

- License issuance

- Open company bank account